23+ How Do I Get A Tin Number For My Business Info

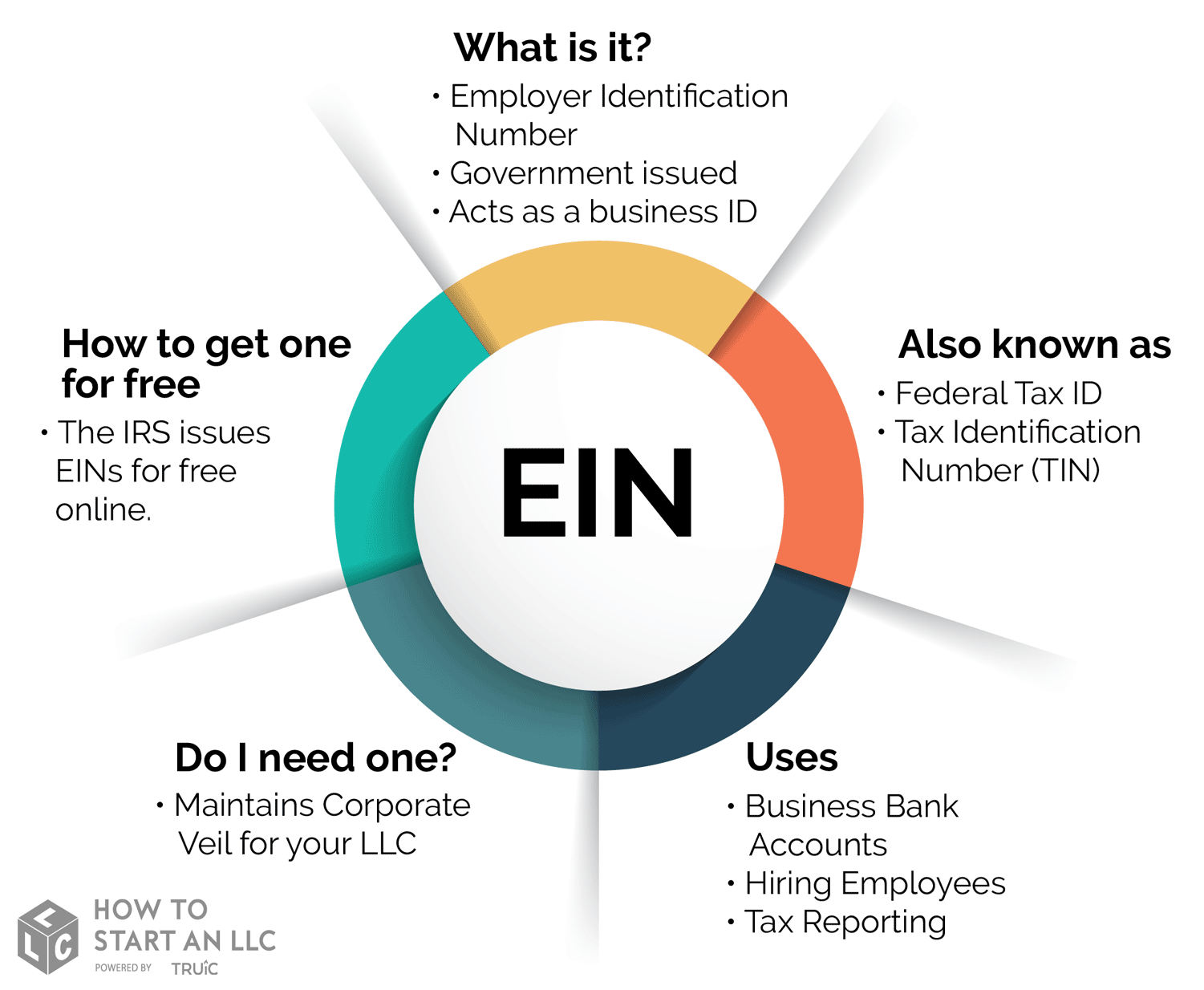

How do i get a tin number for my business. Also known as an Employer Identification Number or EIN it is issued by the IRS to identify small businesses. In order to obtain an ITIN number an applicant must complete IRS Form W-7 the application for Individual Taxpayer Identification Number. To obtain a TIN for a business already incorporated at the Corporate Affairs Commission you will need to go to the Federal Inland Revenue Service FIRS office that is closest to. Applying for this number can be done online at the IRS EIN page online. Once the taxpayer submitted the application form the NSDL dashboard displayed a unique 15 digit acknowledgement number. After registering my company I decided to open a corporate Bank account and TIN is a requirement. Personal Investment opportunities for small business owners. I tried to get it in the tax office in the LGA where the companys registered address is. The EIN acts as a Social Security Number for the business and will be needed throughout its life. You can use the IRSs Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number ITIN. You are limited to one EIN application per day. The IRS issues these identification numbers in accordance with tax law for specific tax purposes.

To apply for a TIN youll need to show the following documents at the tax office. It is free and can be obtained from any Tax office closest to you. How to verify your TIN. TIN Certificate will be sent automatically to registered email. How do i get a tin number for my business To get a TIN as an individual you need to have a NIN or BVN. Select CAC Registration number in the search criteria dropdown list then enter the Number Registered with Corporate Affairs Commision preceeded by the corresponding alphabets eg RC12345 for Corporate entities and BN12345 for Enterprises or as the case may be in the search value field. Structure of a TIN. Your request will be verified and approved. On the alternative they said or I. Individuals are automatically assigned with a TIN based on their BVN Bank Verification Number or NIN National Identity Number. Valid passport with a valid visa or visa exemption Lease agreement of six months or greater including a copy of the landlords ID Proof that you have spent at least 180 days of the last 365 days in Thailand past entry stamps on passport. The easiest way to get an EIN is to apply online for free through the IRS website. Upon getting there I was told to bring N5k that I would not need to go through the rigours of documents and waiting time.

How Do I Get My Tax Identification Number In Nigeria Tax Walls

How Do I Get My Tax Identification Number In Nigeria Tax Walls

How do i get a tin number for my business In order to get an EIN youll also need to fill out an application form but this time through the IRS.

How do i get a tin number for my business. Non Individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association etc can register for their TIN online by clicking here. If you need additional information check out this article on Employer Identification Number or EIN. You will need to determine your eligibility which entity type best suits your goals and then understand the online application.

Fill out BIR Form 1903 submit this with the required attachments to the Revenue District Office having jurisdiction over the business establishments registered address. Company enterprise or individual for identification. The Tax Identification Number TIN is a 14 digit sequential number generated electronically as part of the tax registration process and assigned to all taxpayers.

Pay the P500 Annual Registration Fee to the Authorized Agent Banks of the RDO. According to the Joint Tax Board portal individuals are normally assigned with a TIN based on their BVN Bank Verification Number or NIN National Identity NumberThis means that before you can get a TIN as an individual you must need a NIN or BVN. The same isnt applied for non-individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society.

Non Individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association etc can register for their TIN online by clicking here. Tax ID Numbers TIN The United States requires any foreign investor who wants to form a business in the country to obtain a Tax ID number. An eligible business entity could undertake TIN registration online with NSDL.

How Can I Verify My TIN. It is important that you verify your tax identification number once you receive it. If you have a Social Security Number and your business is located within the United States you will be able to apply for an EIN.

To do that visit firsgovng and click on TIN Verification then go to the search form you will be given three options. To obtain an ITIN you must complete IRS Form W-7 IRS Application for Individual Taxpayer Identification Number. This could be done by filling up TIN Number application form for registration on its website as per the instructions given.

To apply for a TIN depending on the entity selected you will need to go through several steps. The taxpayer identification number is assigned to a business by the IRS and can be used for tax purposes. Search using Tax Identification Number TIN.

How do i get a tin number for my business Search using Tax Identification Number TIN.

How do i get a tin number for my business. The taxpayer identification number is assigned to a business by the IRS and can be used for tax purposes. To apply for a TIN depending on the entity selected you will need to go through several steps. This could be done by filling up TIN Number application form for registration on its website as per the instructions given. To obtain an ITIN you must complete IRS Form W-7 IRS Application for Individual Taxpayer Identification Number. To do that visit firsgovng and click on TIN Verification then go to the search form you will be given three options. If you have a Social Security Number and your business is located within the United States you will be able to apply for an EIN. It is important that you verify your tax identification number once you receive it. How Can I Verify My TIN. An eligible business entity could undertake TIN registration online with NSDL. Tax ID Numbers TIN The United States requires any foreign investor who wants to form a business in the country to obtain a Tax ID number. Non Individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association etc can register for their TIN online by clicking here.

The same isnt applied for non-individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society. According to the Joint Tax Board portal individuals are normally assigned with a TIN based on their BVN Bank Verification Number or NIN National Identity NumberThis means that before you can get a TIN as an individual you must need a NIN or BVN. How do i get a tin number for my business Pay the P500 Annual Registration Fee to the Authorized Agent Banks of the RDO. The Tax Identification Number TIN is a 14 digit sequential number generated electronically as part of the tax registration process and assigned to all taxpayers. Company enterprise or individual for identification. Fill out BIR Form 1903 submit this with the required attachments to the Revenue District Office having jurisdiction over the business establishments registered address. You will need to determine your eligibility which entity type best suits your goals and then understand the online application. If you need additional information check out this article on Employer Identification Number or EIN. Non Individuals such as Limited Liability Companies Incorporated Trustees Enterprises Cooperative Society MDAs Trade Association etc can register for their TIN online by clicking here.

Indeed lately has been hunted by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this post I will discuss about How Do I Get A Tin Number For My Business.

How do i get a tin number for my business. To apply for a TIN depending on the entity selected you will need to go through several steps. The taxpayer identification number is assigned to a business by the IRS and can be used for tax purposes. Search using Tax Identification Number TIN. To apply for a TIN depending on the entity selected you will need to go through several steps. The taxpayer identification number is assigned to a business by the IRS and can be used for tax purposes. Search using Tax Identification Number TIN.

If you re searching for How Do I Get A Tin Number For My Business you've arrived at the ideal place. We have 51 graphics about how do i get a tin number for my business adding pictures, photos, photographs, backgrounds, and more. In such page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.